This visual is dimensioned for a standard 80x200cm popup banner. Ask if you’d like an SVG for print ready use. It is white branded so you can easily add your own logo and strapline using a free vector graphics tool like Inkscape.

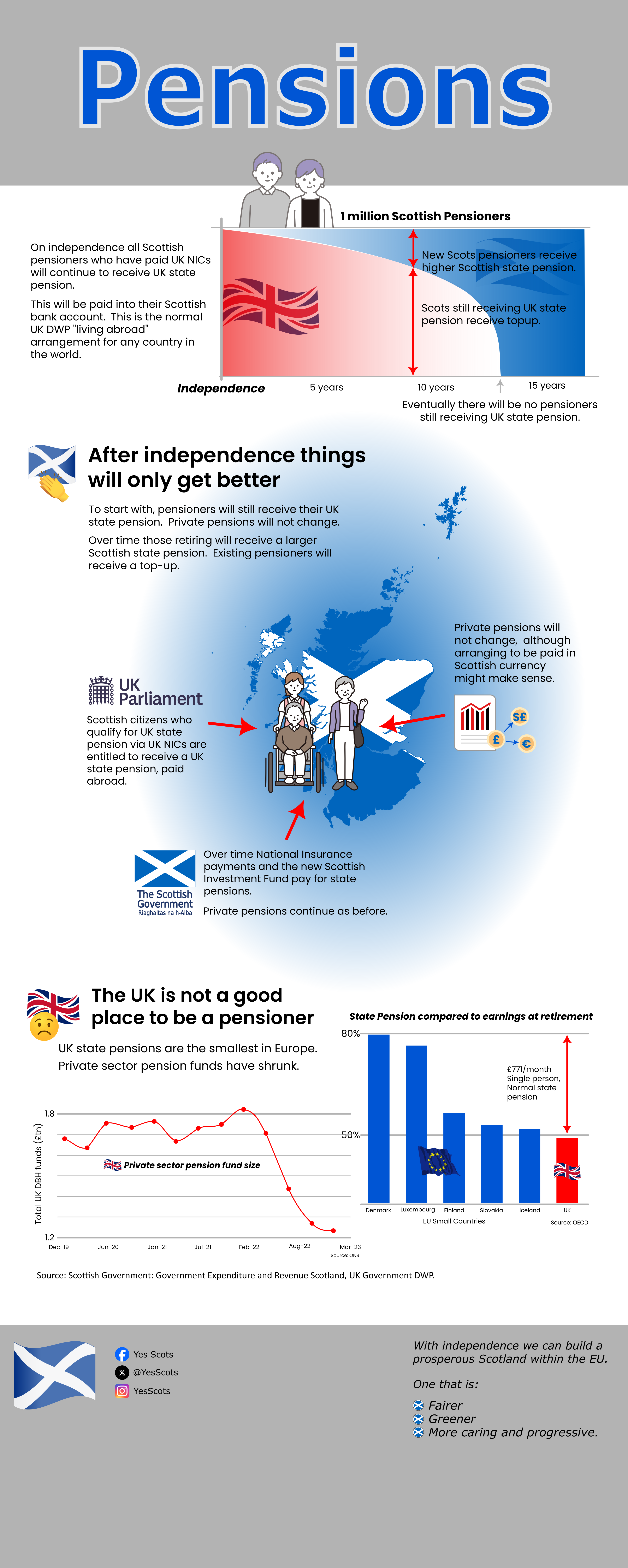

Pensions will be safe after Independence – either the UK Government will continue to pay them as now, or it will agree for the Scottish Government to do this on its behalf.

In fact Scottish pensioners will be better off.

Initially Scotland will have no need to pay a Scottish State Pension unless it decides to top up the UK one.

State Pensions

About one million people in Scotland are currently being paid a UK State Pension.

If you are eligible for a UK State Pension because of your NICs (National Insurance Contributions), the UK Government will pay you the UK State Pension wherever you live in the world. Whether you live in the UK or abroad you will be paid your pension. If you live abroad it’s paid to you in local currency.

When Scotland is independent you simply start “living abroad” from the perspective of the UK Government. There has been some discussion that the Scottish Government might administer this process on behalf of the UK – again this is not uncommon.

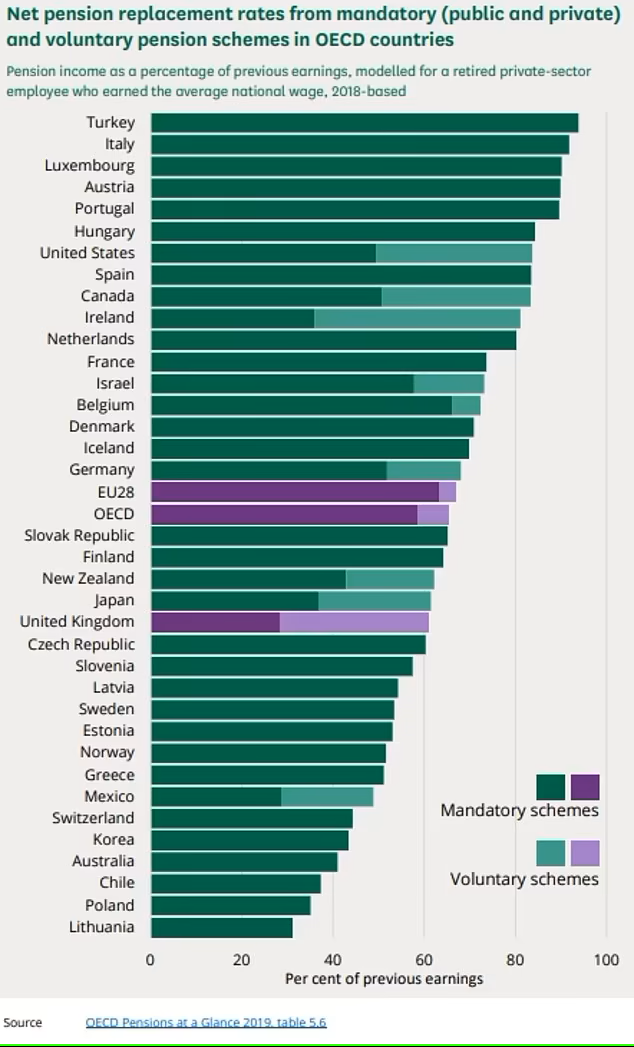

The UK State Pension is one of the lowest in Europe. In 2023 the UK Government spent only about 63% of what it collected in NICs on the state pension.

Private Pensions

It’s likely that once Scotland has started to realise the value of its vast renewable resources – for example via a State Investment Fund – it will also start to invest in more social policies such as a high State Pension.

Private pensions will not change with independence. However if investments are managed by a UK company it may be preferable to move these to a Scottish company.

Existing annuities will not change, although they are likely to continue to be paid in GBP so there may be some exchange rate variations when converting to the Scottish currency. Future annuities will not attract this risk.

Changes over time

Initially the approximately one million Scottish people who receive a UK state pension will continue to do so. Over time this number will reduce. The period between UK state pension eligibility and average life span is about 13 years – so this situation will continue for quite some time.

At the same time people living in Scotland will start to acrew NICs for a Scottish State Pension. In time this will take over from the UK State Pension.

So when Scotland first becomes independent there really is no risk to pensions. In fact over time they are highly likely to go up.

Sources

https://www.statista.com/statistics/283917/uk-state-pension-expenditure/

https://www.gov.uk/government/statistics/hmrc-tax-and-nics-receipts-for-the-uk

https://www.gov.scot/publications/government-expenditure-revenue-scotland-2022-23/pages/5/

https://stat-xplore.dwp.gov.uk/webapi/jsf/tableView/tableView.xhtml

https://www.nrscotland.gov.uk/news/2023/provisional-life-expectancy-figures-released

https://obr.uk/forecasts-in-depth/tax-by-tax-spend-by-spend/national-insurance-contributions-nics/

Alternative formats

An A4 version of this pop-up is also available:

Leave a Reply