After Independence, Scotland’s Green Freeports may provide the potential to help make Scotland’s economy more globally competitive, as well as helping to support both the Scottish Government’s and the EU’s objectives around just transition and the move to a net zero economy.

A complete post reviewing the good and the bad of Green Freeports is here. In this post we gather together some frequently spread myths, and provide fact checked answers to dispell them.

What’s a Green Freeport?

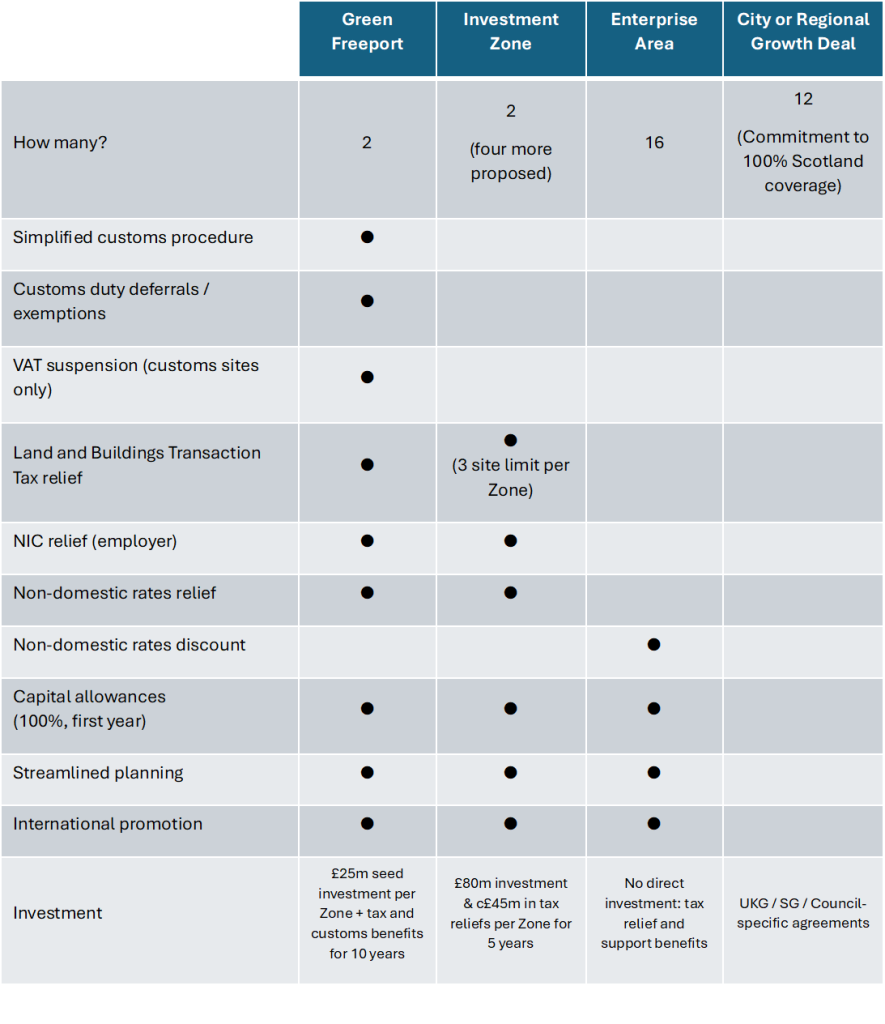

You can read about them in detail here, but a Green Freeport is simply a type of Special Economic Zone – an area where businesses can gain benefits designed to stimulate their operations, in return for investing in Scotland. There are many different types of SEZs, and all countries have them:

Myth busting

Initially true, but ultimately not the case.

The UK Government’s original Freeports proposal was unacceptable to the Scottish Government and changes were proposed but not accepted. However the UKG was unable to progress with its intended proposals in Scotland because in some areas they were dependent on devolved areas. After a period of negotiation, the UKG was forced to accept this reality. The compromise agreed was:

- There would be a joint procurement process run by both UKG and SG

- In return, Scottish Green Freeports would include additional mandatory areas in their prospectus reflecting the SG’s specific objectives for Scotland (supporting Fair Work First practices, creating new green jobs, upholding the highest environmental protections, and supporting just transition). These would continue to be omitted from the UK Freeports destined for England

- UKG would provide SG with comparable additional funding and subsidies to those provided in England.

In 2022 UK and SG published the agreement and announced the intention to establish two Green Freeports in Scotland. SG issued the bidding prospectus for Scotland. In 2023 the two winners were

This is not correct.

The changes required to support the tax benefits provided to Green Freeports were captured in changes passed by the Scottish Parliament to the Land and Buildings Transaction Tax (Scotland) Act 2013 via The Land and Buildings Transaction Tax (Green Freeports Relief) (Scotland) Order 2023[3] which came into effect in Oct-2023.

True, but not relevant.

All employment law for Scotland is reserved to Westminster, and hence this reservation of powers applies to Green Freeports as well. However no changes to employment law have been passed that apply specifically to Scottish Green Freeports.

In fact the Scottish Government introduced a requirement for all successful Green Freeport bidders to support Fair Work First[4] practices – guidelines that are already in place for other Scottish public sector grants, other funding and public contracts. These include, for example, payment of at least the real Living Wage and no inappropriate use of zero hours contracts. Note – this requirement does not exist for Freeport contracts let in England and Wales by the UK Government.

This is not correct.

The organisations awarded a Green Freeport contract do not take ownership of any land. Green Freeports are areas within which preferential terms for business operation will be allowed. Their function is to administer the investment grant of £25m provided by the UK Government across their designated geographic area, as well as compliance with the terms of the investment as per the Scottish Government’s requirements.

To be clear, “Green Freeport land” refers to land that an organisation might acquire which falls within the Green Freeport area, and therefore may benefit from Land and Buildings Transaction Tax relief – but ownership of that land does not change simply because of this tax relief designation[5].

This is not correct.

In 2021 Forth Ports got the green light from the Fife Council to fence off the working part of the harbour in Burntisland on the grounds of health and safety and to make the site safe and secure. The move proved hugely contentious among locals who argued the port has been used by walkers, cyclists anglers, photographers and wildlife enthusiasts for generations and is an integral part of the town.

A spokesperson from Forth Ports said: “As the owners of the Port of Burntisland, we are legally responsible for ensuring the safety of everyone at what is a working harbour. Prior to receiving planning permission from Fife Council and before the fence was installed in 2022, we consulted widely with community representatives and local politicians and we continue to be heavily involved in local community support and engagement. The fence still enables the people of Burntisland to walk through the port, but safely and avoiding areas of higher risk.”[26].

This is not correct.

There is no change in income tax liabilities, employment or health and safety law for companies operating within a Green Freeports area. However companies operating within a Green Freeports area may benefit from reduced Land and Buildings Transaction Tax and VAT.

In fact the Scottish Government introduced a requirement for all successful Green Freeport bidders to support Fair Work First[6] practices – guidelines that are already in place for other Scottish public sector grants, other funding and public contracts. These include, for example, payment of at least the real Living Wage and no inappropriate use of zero hours contracts. Note – this requirement does not exist for Freeport contracts let in England and Wales by the UK Government.

Regarding planning, the Scottish Government took the opportunity of Green Freeports to modernise permitted development rights (PDR) as part of its wider planning reform programme[7]. PDRs allow change without the need to apply for planning permission. With Green Freeports, Council planning authorities can adopt new mechanisms like Masterplan Consent Areas[8] to streamline and speed up the planning process and allow the authority and businesses to work more strategically together[9].

Regarding National Insurance Contributions (NICs), for companies operating designated “tax sites” within a Green Freeports area it is possible to gain relief on Employer’s National Insurance Contributions (employees will still pay their NICs). Forth Green Freeport has three designated tax sites; Inverness and Cromarty Firth Green Freeport has five.

Partially correct.

No changes to employment law have been passed that apply specifically to Scottish Green Freeports. In fact the Scottish Government introduced a requirement for all successful Green Freeport bidders to support Fair Work First[10] practices – guidelines that are already in place for other Scottish public sector grants, other funding and public contracts. These include, for example, payment of at least the real Living Wage, which is significantly higher than the statutory minimum wage, and no inappropriate use of zero hours contracts. Note – this requirement does not exist for Freeport contracts let in England and Wales by the UK Government.

Companies operating within designated tax sites within a Green Freeports area can apply for Employer’s National Insurance Contributions. No such relief is available for income tax.

It is true that companies operating outside the Green Freeports zones will not receive Green Freeports benefits – and it is conceivable that they may simply move to take advantage of these benefits, thus creating no net benefit. It is too early to identify evidence to support this view. However Green Freeports are not the only business growth schemes available in Scotland by any means. A range of others exist encompassing the entire country, from City and Region Deals to Enterprise Areas and Investment Zones.

This is not correct.

The UK Government has budgeted for the investment benefits it anticipates that companies will receive as a result of operating in Green Freeport zones – and this budget will compensate for lost tax and Employer’s NICs relief etc. This is reflected in the block grant provided to the Scottish Government.

This is not correct.

Green Freeport zones are administered by Green Freeport operating companies contracted to the Scottish Government under Scottish law.

This is not correct.

A moratorium was placed on the granting of hydraulic fracturing, better known as fracking, licences by the Scottish Government in 2019. This means the SG will not support any “unconventional oil and gas”, which includes fracking.

While parts of the planning process will be “streamlined” within Green Freeports to stimulate investment, for fracking to take place it still needs to be licenced by the SG, and it has confirmed that it does not intend to grant any licences. This policy is confirmed in Policy 33 of the National Planning Framework 4, which sets out the SG’s planning policy priorities: “The Scottish Government does not support the development of unconventional oil and gas in Scotland”[11].

This is not correct.

The main issue to be addressed is the UKG’s decision to provide WTO levels of state aid that breach EU state aid rules. Since 1996, the EU has banned most SEZs (which includes Free Zones) – although there are many exceptions such as “export processing zones” (there are currently more than 100) and “economic revitalisation projects” (more than 150 in France only). However in general this state aid ban was made explicit by the 2007 Treaty on the Functioning of the EU[12].

Despite this position many eastern European countries such as Poland and Croatia were allowed to grandfather-in pre-existing SEZs when they joined the EU[13]. Since 2018, tax exemptions in Poland have been available for companies carrying out new investments across the entire country, not just within SEZs.

And most recently the EU passed an “amending regulation” in 2017[14] affecting aid for port and airport infrastructure, which once again allows regulatory exceptions to be granted on a geographical basis. All the signs suggest that the EU is softening its position on Free Zones.

The UKG, as part of the negotiation of the EU/UK Trade and Cooperation Agreement (the Brexit agreement), agreed to subsidy control provisions and passed the Subsidy Control Act 2022 to implement a framework for tracking and managing subsidies provided by local and national governments[15]. This regime would assist Scotland in demonstrating subsidy controls to the EU as part of any pre-accession negotiation. Indeed, the status of any Freeport-related public subsidy can be readily browsed via the UKG Subsidies Database[16]. The only relevant subsidy at the time of writing is the “Green Freeport Land and Buildings Transactions Tax (LBTT) Relief: Green Freeports in Scotland” valued at £25m[17].

So whether Scotland argues to “grandfather-in” its existing Green Freeports, or treats them as exceptions under the 2017 amending Regulation, it looks likely that they would not prevent Scotland’s entry into the EU. And in any case, SG would have the power to adjust Green Freeport state aid to make sure they match EU acceptable levels. These levels of state aid are defined in the EU’s General Block Exemption Regulation (GBER)[18].

Potential disputes arising from Freeport subsidy changes

Some argue that there still remains a risk that foreign private organisations involved in the Green Freeports will sue for negative impact, should state aid reduce. If this were to happen it is most likely to be via international law arbitration using Investor–state dispute settlement (ISDS) rules. These allow investors who feel they have been affected negatively by states to sue for compensation. To be able to do this both the foreign organisation’s country of origin and the UK (Scotland after independence) must hold a bilateral agreement for international investment[19].

The UK’s strategic position on ISDS is unclear post-Brexit: it’s deals with Canada and New Zealand exclude ISDS, but its CPTPP does not. Whilst the UKG has proposed to include ISDS in its UK-USA trade deal, this deal has not been agreed and its incorporation is considered controversial. Labour’s current position is unclear, but many in its organisation have proposed that ISDS should not form part of UKG trade policy[20]. In an EU reform, such bilateral agreements between EU member states have been removed[21]. Scotland’s position on ISDS will clearly align with the EUs once it becomes a member state. Currently the Scottish Government opposes them as a part of UKG free trade organisations[22].

Regarding foreign organisations and their involvement in Scotland’s Green Freeports, currently only one (Norwegian) company plays a role. Norway is an EFTA member and as a matter of policy is removing bilateral ISDS agreements between other EFTA, and EU, member states[23].

Alignment of Green Freeports and the EU Green Deal

One key benefit of Scotland’s Green Freeports – and one not present in UKG’s Freeports for England – is the close match between SG’s additional objectives and those of the EU for its European Green Deal. In particular, the EU has proposed that Free Zones modernise to support its Green Deal[24]. Green Freeports already go some way to achieving this and so are likely to be viewed by the EU as “modern” Free Zones.

For example, the Inverness and Cromarty Firth Green Freeport has already announced plans for a North of Scotland Hydrogen Programme to develop state-of-the-art green hydrogen hub[25].

This is not correct.

The UK – and Scotland’s – democracy is built on the rule of law. This means that no government can do anything unless it can point to the law which gives it the power to do so. This makes sure that government bodies and other agencies can’t interfere with our freedom without Parliamentary approval; we are all, including government, equal before the law.

To ensure this happens, powers are separated into three areas: legislature, the executive and the judiciary. The executive (government) proposes laws; the legislature (parliament) oversees the executive and creates the laws; and the judiciary (police, fiscals, sheriffs and the courts) interprets, enforces and applies the laws [27].

Sources

[1] https://greenfreeport.scot/about/

[2] https://forthgreenfreeport.com/

[3] https://www.legislation.gov.uk/sdsi/2023/9780111057735/schedules

[4] https://www.gov.scot/publications/fair-work-first-guidance-2/pages/2/

[5] https://revenue.scot/taxes/land-buildings-transaction-tax/lbtt-legislation-guidance/lbtt3001-exemptions-reliefs/lbtt3010-tax-reliefs/lbtt3049-green-freeports

[6] https://www.gov.scot/publications/fair-work-first-guidance-2/pages/2/

[7] https://www.gov.scot/publications/review-permitted-development-rights-phase-2-consultation/pages/1/

[8] https://www.gov.scot/publications/masterplan-consent-areas-consultation-draft-regulations/pages/2/

[9] https://assets.publishing.service.gov.uk/media/64ad1a35e1aab2000c03acd8/Green_Freeports_-_Guidance_-_Green_Freeport_Setup_Phase.pdf

[10] https://www.gov.scot/publications/fair-work-first-guidance-2/pages/2/

[11] https://www.gov.scot/binaries/content/documents/govscot/publications/strategy-plan/2023/02/national-planning-framework-4/documents/national-planning-framework-4-revised-draft/national-planning-framework-4-revised-draft/govscot%3Adocument/national-planning-framework-4.pdf

[12] https://eur-lex.europa.eu/EN/legal-content/summary/treaty-on-the-functioning-of-the-european-union.html

[13] https://www.fdiintelligence.com/content/opinion/its-time-for-the-eu-to-reverse-its-sez-ban-81947

[14] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:32017R1084

[15] https://researchbriefings.files.parliament.uk/documents/CBP-8823/CBP-8823.pdf

[16] https://searchforuksubsidies.beis.gov.uk/

[17] https://searchforuksubsidies.beis.gov.uk/scheme/?scheme=SC11042

[18] https://eur-lex.europa.eu/EN/legal-content/summary/general-block-exemption-regulation.html

[19] https://en.wikipedia.org/wiki/Investor%E2%80%93state_dispute_settlement

[20] https://yourbritain.org.uk/commissions/trade-justice-movement-labour-s-progressive-trade-policy

[21] https://ukandeu.ac.uk/reforming-investor-state-dispute-settlement-eu-initiatives-and-uk-ambivalence/

[22] https://www.gov.scot/publications/scotlands-vision-trade-annual-report-june-2023/pages/5/

[23] https://www.iisd.org/itn/en/2023/07/01/norway-terminates-its-iias-with-european-economic-area-members/

[24] https://op.europa.eu/en/publication-detail/-/publication/a40ce9b8-68d0-11ee-9220-01aa75ed71a1/language-en

[25] https://greenfreeport.scot/green-hydrogen/

[26] https://www.fifetoday.co.uk/news/people/burntisland-harbour-group-urges-fife-council-to-tackle-access-in-fight-the-fences-campaign-4703752

[27] https://files.justice.org.uk/wp-content/uploads/2017/05/06170654/Law-For-Scottish-Lawmakers.pdf

Leave a Reply