After Independence, Scotland’s Green Freeports may provide the potential to help make Scotland’s economy more globally competitive, as well as helping to support both the Scottish Government’s and the EU’s objectives around just transition and the move to a net zero economy.

Right now the risk is that the Scottish Government is overridden and they are forced into the direction that UK Freeports are taking in England, where divergence from EU aims seems inevitable. What are they? Why might they be a good thing?

This content is also available as a Research Briefing that can be downloaded:

Scottish Green Freeports are NOT UK Freeports

Scottish Green Freeports are NOT the same as UK Freeports – although they share some common elements e.g. around tax subsidies. Their invention, implementation, objectives and management are materially different to the approach adopted by the UK Government (UKG). Delivered by the Scottish Government (SG), they reflect the quite different political nature of the two governments – which in turn reflect the differing societal attitudes of Scotland and England in the 21st Century.

If you favour a society that reflects Centre Left progressive values, rather than increasingly Right-Wing self-interest, then you’ll most likely prefer the Scottish approach. You will how this is reflected in the prospectus objectives and resulting partnership structure of the Scottish Freeports. These are quite different to their counterparts in England.

Freeports – good or bad?

Green Freeports are not an economic panacea. Like any Freeport they can be criticised for potential harm – for example job and investment displacement, rather than creation; and exploitation by those seeking to evade tax. Elsewhere in the world some freeport frameworks can be seen as an attack on workers’ rights – there is no evidence for this in Scotland, beyond the more general risks to Scotland that UKG initiatives such as the Retained EU Law (Revocation and Reform) Act 2023 present[1].

Despite this criticism, many states believe them to be useful additions to help drive economic progress in a competitive world of business. In the EU alone 21 member states have 68 Free Zones[2]. It’s estimated that there may be as many as 4,300 globally[3]. However each state and region has implemented freeports in their own way.

The merits of Freeports per se are not discussed further here – many academics and journalists are very wary of their net benefits – particularly as UKG is implementing them[4]. The remainder of this discussion will focus on how Scottish Green Freeports differ from the UK Freeports that UKG has implemented; and their evolution and impact as Scotland becomes independent and joins the EU.

The history behind Scottish Green Freeports

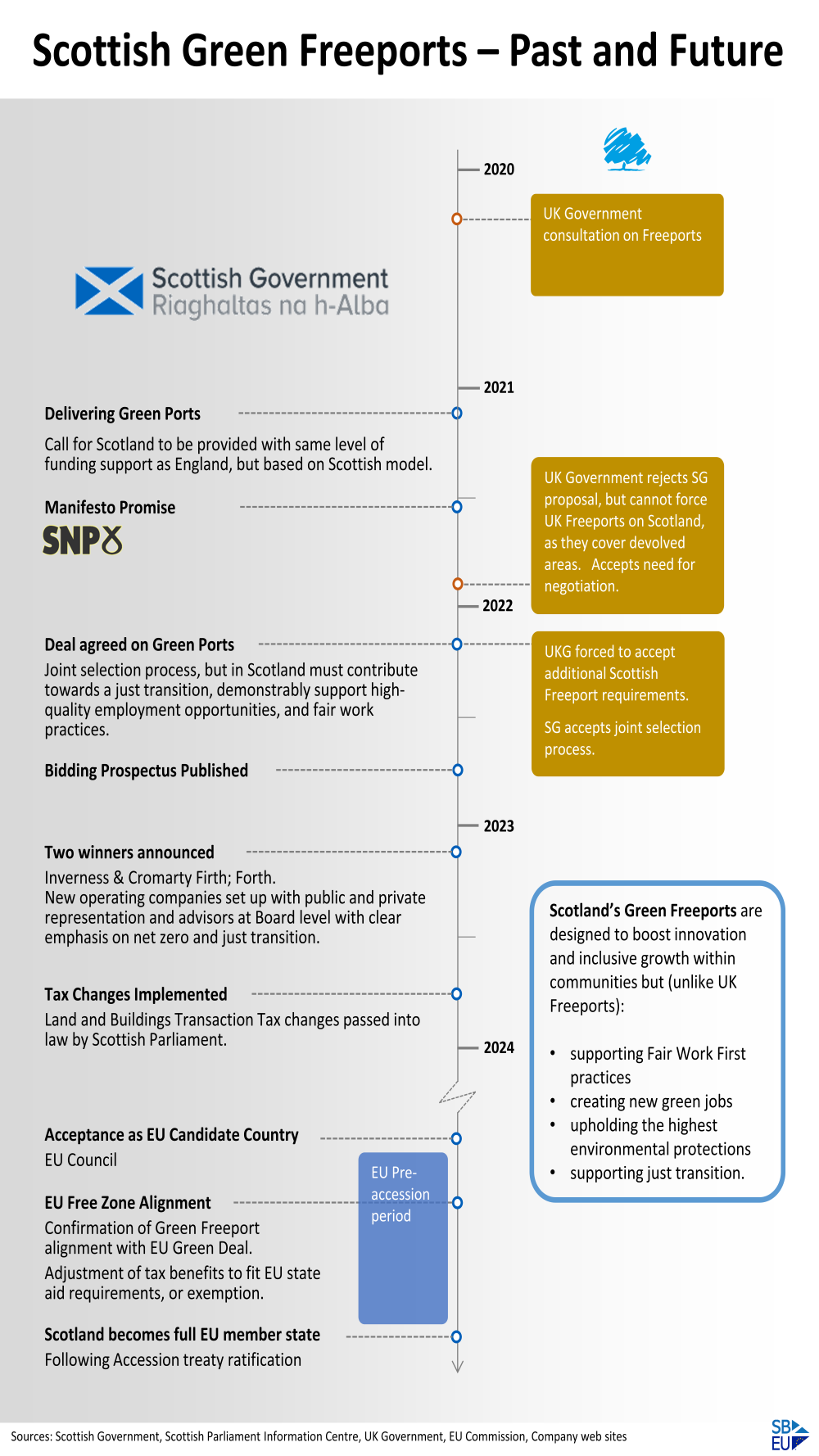

In 2020 the Tory UKG published its consultation on Freeports. Its stated objective was to enable areas of the UK with different customs rules than the rest of the country, that were innovative hubs, boosted global trade, attracted inward investment and increased productivity. As we’ll see, these are quite different to the additional objectives of the Scottish Government (SG).

For the UKG, Freeports were seen as a way to drive its post-Brexit agenda of new found “freedom”. No longer tied to EU state aid constraints, it could put in place a different set of incentives and subsidies based on a, lower, WTO standard. These provide[5]:

- Ten years of tax reliefs:

- Stamp Duty Land Tax relief (or Land and Buildings Transaction Tax relief in Scotland or Land Transaction Tax relief in Wales)

- enhanced capital allowances for investment in plant & machinery and structures & buildings

- five years of business rates relief (or non-domestic rates relief in Scotland and Wales)

- Employer National Insurance contributions relief.

- Customs and planning:

- simplified customs procedure

- tariff benefits including deferred payment of import duties and exemption for re-export

- non-tariff benefits from simplified import procedures

- deferrals and exemptions from duty payments

- VAT suspension within customs sites.

- simplified customs procedure

The recent history of Freeports in Scotland

Prior to the establishment of the UK Freeports there was much speculation that, as has happened in some other countries, this would be taken as an opportunity to water down workers’ rights. The UKG claims that UK Freeports are areas that are subject to relevant UK employment laws and protections, just like any other area of the UK – and that workers’ rights are not implicitly affected[6]. In fact they present an opportunity for Freeport operators and Unions to agree progressive approaches – should they wish to (or are encouraged to) do so.

The UK’s Office for Budget Responsibility estimates that UK Freeports will cost the UKG £50m/yr in addition to £25m per port seed capital[7].

In 2021 the UKG announced 8 locations in England that had been selected for Freeports and an aspiration to implement similar Freeports in Scotland. The SG rejected UKG’s model for Scotland and proposed its own plans to move forward with freeports based on a different special economic zone (SEZ) model[8]. UKG threatened to proceed unilaterally in Scotland.

Subsequently SG called on UKG to provide comparable levels of funding for the SG to set up its own Freeports model in Scotland – but with additional objectives in mind. These became Green Freeports and their stated objective is to boost innovation and inclusive growth within communities while also:

- supporting Fair Work First practices

- creating new green jobs

- upholding the highest environmental protections

- supporting economic transformation (i.e. just transition from a fossil-fuel based economy to one based on renewable energy)[9].

The UKG refused SG’s proposal. This is unsurprising – throughout the UKG’s current 14 year span in power the Tory party has worked to subvert and openly veto where possible the work of the SG, which it views as a political anathema. The SG Centre Left administration is a coalition of Scottish National Party and Scottish Green Party and holds an outright majority support from voters in Scotland. Conversely, Scottish voters have not supported the Tory party in UKG since 1955, and the Tory party has never held power in the SG.

The UKG’s preference would have been to simply force the UK Freeport model on Scotland. However, Freeports span powers held by both the SG (devolved powers) and the UKG (retained powers). This meant that Scottish Freeports could not be implemented by either party on their own. After a period of negotiation, the UKG was forced to accept this reality. The compromise agreed was:

- There would be a joint procurement process

- In return, Scottish Green Freeports would include additional mandatory areas in their prospectus reflecting the SG’s objectives (see above). These would continue to be omitted from the UK Freeports destined for England

- UKG would provide SG with comparable additional funding and subsidies to those provided in England.

In 2022 UK and SG published the agreement and announced the intention to establish two Green Freeports in Scotland. SG issued the bidding prospectus for Scotland. In 2023 the two winners were announced: Inverness and Cromarty Firth Green Freeport[10], and Forth Green Freeport[11].

The Scottish Parliament passed into law the Land and Buildings Transaction Tax changes need to support the tax benefits provided to Green Freeports.

The Future of Freeports

UK Government Future Ambition

The UKG has opaque ambitions for UK Freeports – although its general attitude to post-Brexit governance[12] makes reference to “regulatory burden” and other rightist trigger phrases that suggest it sees Freeports as a vehicle for significant deregulation – potentially undermining employment rights, environmental laws and more. However its important to note that Green Freeports operate under the jurisdiction of the SG, and any change specific to freeports would most likely need both SG and UKG to agree.

Without hugely significant constitutional change, SG will continue to govern devolved areas of power, and UKG retained areas. Any other changes to Green Freeports that fall within devolved areas would require SG agreement. SG has made no suggestion of any intent to deviate from its initial objectives. Indeed, the “Scottish” objectives added by SG very much reflect the core principles of the SNP in its offer to the Scottish people.

The Labour party has not stated its position on UK Freeports, other than to suggest that they are only a limited part of a much larger plan for economic groupw – but it is reasonable to assume that it will be no more right wing than the current Tory position[13]. Any movement back towards a more progressive model would necessarily align UK Freeports more with the Scottish Green Freeport model.

Scottish Government Future Ambition

Since an independence referendum in 2014, about half of Scotland’s voters have favoured independence. Only the oldest age groups are against, with the majority age cut-off rising steadily[14]. A significant part of the 2014 campaign for Scotland to remain in union with England was the argument that this was the only way to guarantee remaining in the EU. In 2016 all areas of Scotland voted to remain in the EU and support for the EU has only grown since, with about 72% current support[15].

The Scottish Government – including all Scottish political parties (Alba, SNP, Scottish Greens) – is committed to regaining Scotland’s independence at the earliest opportunity, followed by application to join the EU[16]. It is therefore important to consider the implications of Green Freeports for Scotland’s ambitions to become independent and join the EU.

During the EU pre-accession period candidate countries work with the EU Commission to identify and address divergence from Acquis – the EU’s directives and rules. Whilst Scotland is relatively close to Acquis as a result of the UK’s prior membership of the EU, Green Freeports do cause some divergence – as well as new areas of alignment.

Green Freeports and EU Acquis

The main issue to be addressed is the UKG’s decision to provide WTO levels of state aid that breach EU state aid rules. Since 1996, the EU has banned most SEZs (which includes Free Zones) – although there are many exceptions such as “export processing zones” (there are currently more than 100) and “economic revitalisation projects” (more than 150 in France only). However in general this state aid ban was made explicit by the 2007 Treaty on the Functioning of the EU[17].

Despite this position many eastern European countries such as Poland and Croatia were allowed to grandfather-in pre-existing SEZs when they joined the EU[18]. Since 2018, tax exemptions in Poland have been available for companies carrying out new investments across the entire country, not just within SEZs.

And most recently the EU passed an “amending regulation” in 2017[19] affecting aid for port and airport infrastructure, which once again allows regulatory exceptions to be granted on a geographical basis. All the signs suggest that the EU is softening its position on Free Zones.

The UKG, as part of the negotiation of the EU/UK Trade and Cooperation Agreement (the Brexit agreement), agreed to subsidy control provisions and passed the Subsidy Control Act 2022 to implement a framework for tracking and managing subsidies provided by local and national governments[20]. This regime would assist Scotland in demonstrating subsidy controls to the EU as part of any pre-accession negotiation. Indeed, the status of any Freeport-related public subsidy can be readily browsed via the UKG Subsidies Database[21]. The only relevant subsidy at the time of writing is the “Green Freeport Land and Buildings Transactions Tax (LBTT) Relief: Green Freeports in Scotland” valued at £25m[22].

So whether Scotland argues to “grandfather-in” its existing Green Freeports, or treats them as exceptions under the 2017 amending Regulation, it looks likely that they would not prevent Scotland’s entry into the EU. And in any case, SG would have the power to adjust Green Freeport state aid to make sure they match EU acceptable levels. These levels of state aid are defined in the EU’s General Block Exemption Regulation (GBER)[23].

Potential disputes arising from Freeport subsidy changes

Some argue that there still remains a risk that private organisations involved in the Green Freeports will sue for negative impact, should state aid reduce. If this were to happen it is most likely to be via international law arbitration using Investor–state dispute settlement (ISDS) rules. These allow investors who feel they have been affected negatively by states to sue for compensation. To be able to do this both the foreign organisation’s country of origin and the UK (Scotland after independence) must hold a bilateral agreement for international investment[28].

The UK’s strategic position on ISDS is unclear post-Brexit: it’s deals with Canada and New Zealand exclude ISDS, but its CPTPP does not. Whilst the UKG has proposed to include ISDS in its UK-USA trade deal, this deal has not been agreed and its incorporation is considered controversial. Labour’s current position is unclear, but many in its organisation have proposed that ISDS should not form part of UKG trade policy[29]. In an EU reform, such bilateral agreements between EU member states have been removed[30]. Scotland’s position on ISDS will clearly align with the EUs once it becomes a member state. Currently the Scottish Government opposes them as a part of UKG free trade organisations[31].

Regarding foreign organisations and their involvement in Scotland’s Green Freeports, currently only one (Norwegian) company plays a role. Norway is an EFTA member and as a matter of policy is removing bilateral ISDS agreements between other EFTA, and EU, member states[27].

Alignment of Green Freeports and the EU Green Deal

One key benefit of Scotland’s Green Freeports – and one not present in UKG’s Freeports for England – is the close match between SG’s additional objectives and those of the EU for its European Green Deal. In particular, the EU has proposed that Free Zones modernise to support its Green Deal[24]. Green Freeports already go some way to achieving this and so are likely to be viewed by the EU as “modern” Free Zones.

For example, the Inverness and Cromarty Firth Green Freeport has already announced plans for a North of Scotland Hydrogen Programme to develop state-of-the-art green hydrogen hub[25].

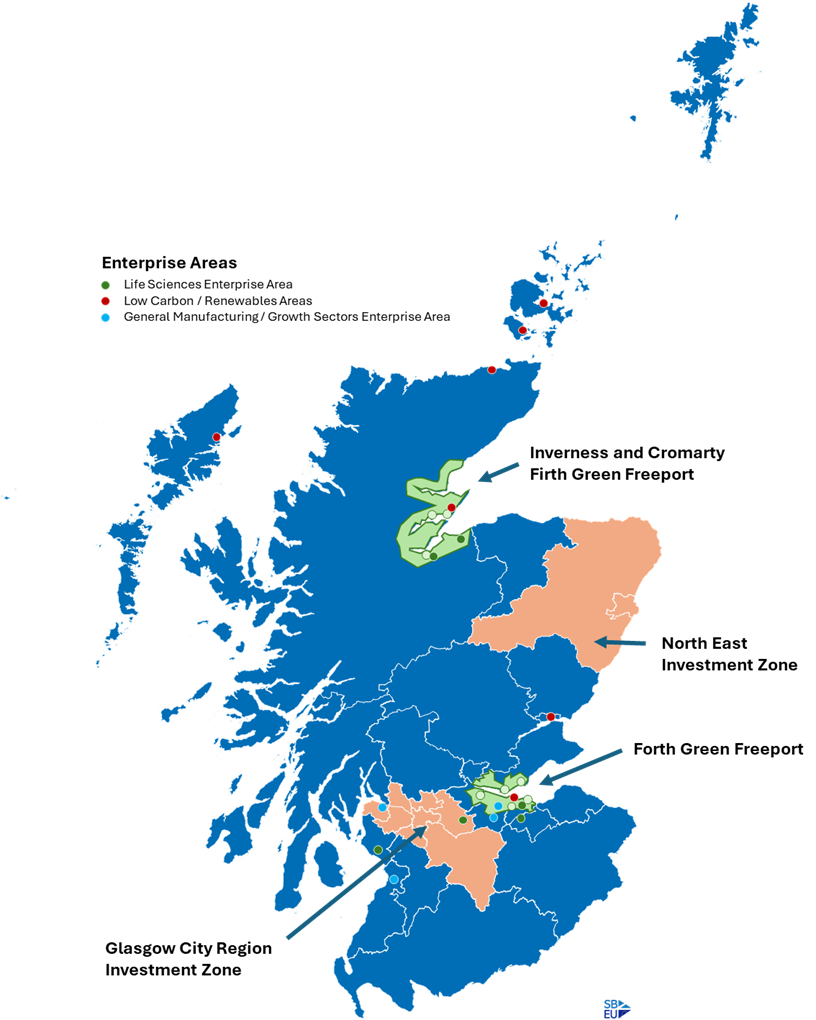

Scotland’s Green Freeports

The SG has awarded two Green Freeports licences – one to the Inverness and Cromarty Firth Green Freeports, and the other to the Forth Green Freeport. Let’s consider these in more detail.

Inverness and Cromarty Firth Green Freeport

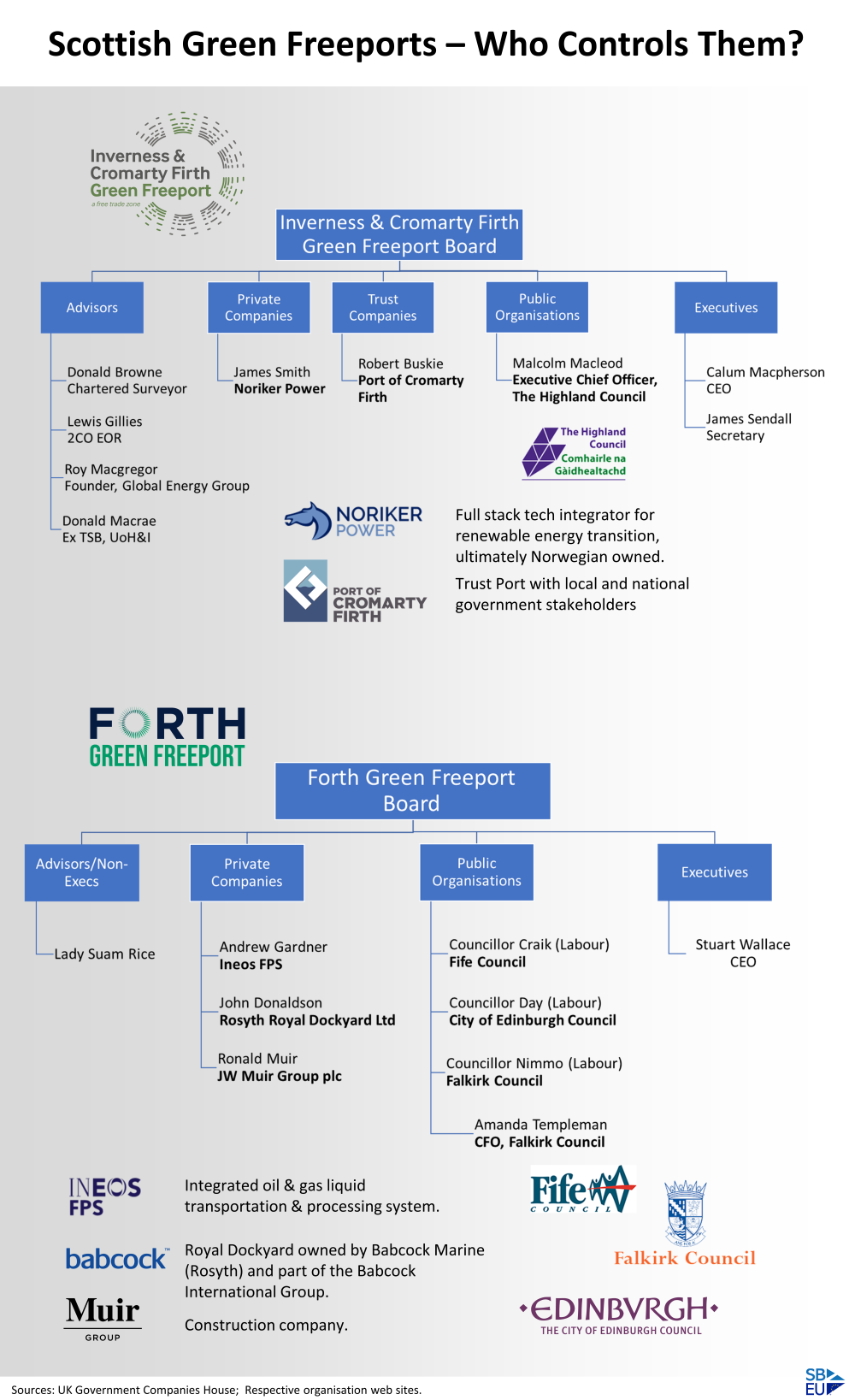

Following award of Green Freeport status in 2023, Inverness and Cromarty Firth Green Freeport Ltd became active. It has a board constituted with a mix of private and public partners who have a core interest aligned to the Green Freeport objectives:

- Port of Cromarty Firth – a “Trust Port” operating as an independent statutory body and governed by stakeholders rather than shareholders that include staff and customers, businesses throughout Cromarty Firth and the Highlands, local communities and local and national government.

- Noriker Power – providers of full stack renewable energy transition services, ultimately owned by Equinor Asa – an international energy company based in Norway, and with ambition to become a leading company in energy transition to renewables.

- The Highland Council/Comhairle na Gàidhealtachd.

- Advisors/Non-Execs with backgrounds in

- Carbon Capture and Storage (CCS) and Enhanced Oil Recovery (EOR)

- Port of Nigg and on/off-shore energy-related technology

- Chartered surveying.

The appointed CEO is Calum MacPherson – an Inverness native and Aberdeen law graduate who specialised in tax law. He was Area Manager, Moray Region for Highlands & Islands Enterprise before leading Robertson Capital Projects for the Stirling-based Robertson Group[26].

It is clear from this structure that the Green Freeport is supported by locally based organisations who already have vested interests in the area. The structure also includes organisations and advisors with expertise that matches closely the SG’s additional objectives for Green Freeports around achieving net zero and just transition away from Oil and Gas dependence towards renewable energy sources.

Forth Green Freeport

The second Green Freeport licence awarded by the Scottish Government was to the Forth Green Freeport Ltd. It also has a board constituted with a mix of private and public partners who have a core interest aligned to the Green Freeport objectives:

- Ineos FPS Ltd – an integrated oil & gas liquid transportation & processing system based in South Queensferry.

- Rosyth Royal Dockyard Ltd – owned by Babcock Marine (Rosyth) and part of the Babcock International Group.

- J.W. Muir Group Plc – a construction company based in Inverkeithing, Fife.

- Advisors/Non-Execs:

- Dame Susan Rice – British banker, company and charity director and Chair of Scottish Water, Business Stream, North American Income Trust, and non-executive director of the Office for Budget Responsibility. In 2000 she became the first women to lead a British clearing bank.

As with Scotland’s other Green Freeport, the Forth Green Freeport is controlled by a set of public and private organisations with vested interests in the local area. Whilst lacking the immediately relevant track record of Inverness and Cromarty Firth Green Freeport partners in net zero and just transition, this organisation does include three Labour councillors from the local councils of Fife, Falkirk and City of Edinburgh – one would hope that this would help ensure that the Freeport stayed focused on its primary objectives.

Certainly the Labour Leader of Edinburgh City Council has stated that “the Forth Green Freeport win will drive forward net zero goals and tap into the Capital’s coastal ambitions” … “The Forth Green Freeport will bring significant economic and other benefits to the region – most obviously in terms of new jobs, creating up to 50,000 in total, 11,000 of which will be here in Edinburgh.” [32].

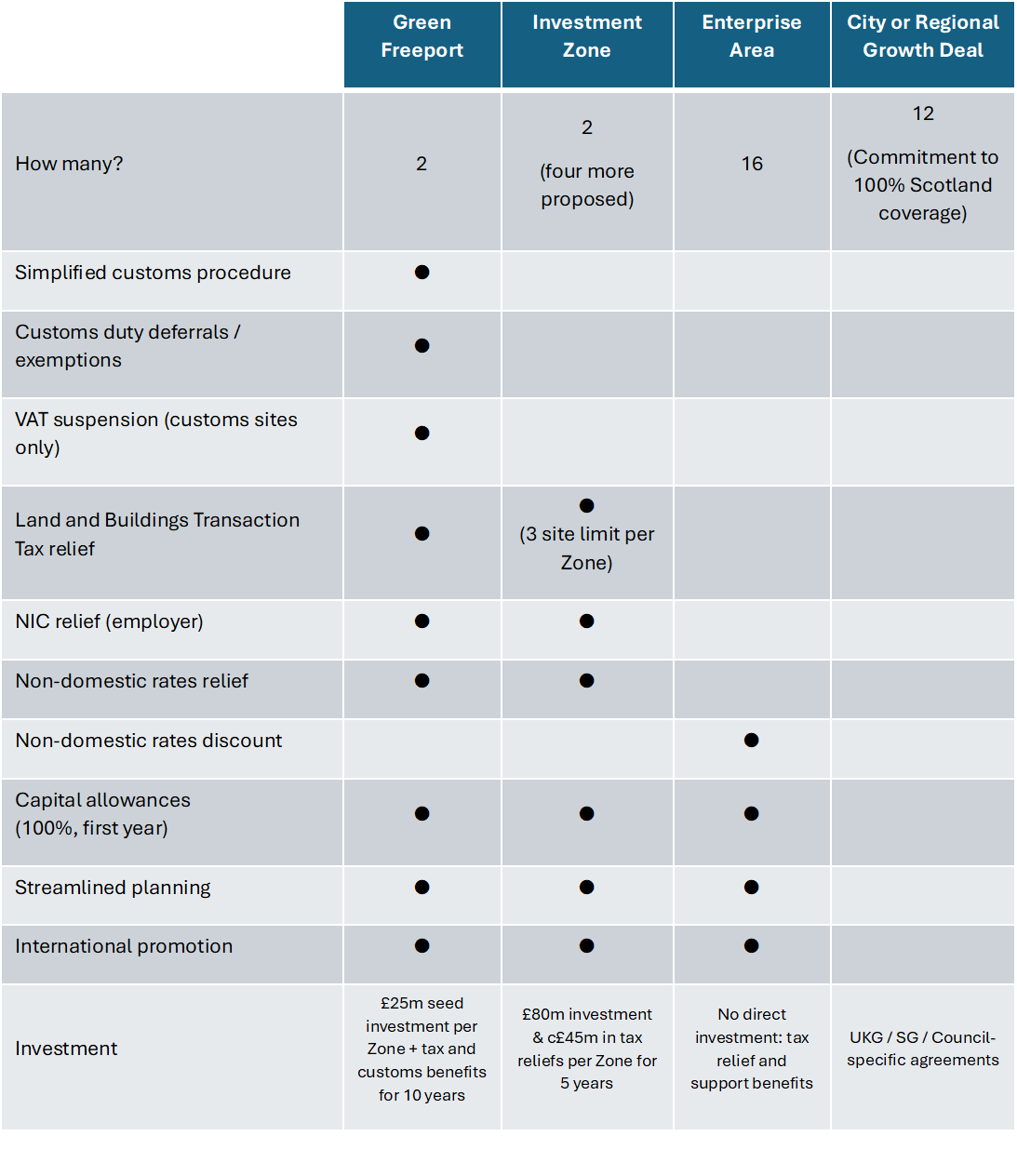

Green Freeports and other Scottish Government economic investments

The Scottish Government invests in the economy in various ways – sometimes with capital investment, sometimes as Special Economic Zones (SEZs) including tax benefits – and some SEZs, like Green Freeports, with additional benefits such as simplified customs processes. Here’s how they compare:

The map below shows the location of Scotland’s current SEZs:

Sources

[1] https://www.gov.scot/publications/retained-eu-law-bill-what-does-it-mean/

[2] https://taxation-customs.ec.europa.eu/system/files/2022-08/FZ%20LIST%2017%20August%202022_CLEAN.pdf

[3] https://blogs.sussex.ac.uk/uktpo/publications/what-is-the-extra-mileage-in-the-reintroduction-of-free-zones-in-the-uk/

[4] https://www.theguardian.com/commentisfree/2022/aug/17/freeport-turbocapitalism-tramples-over-british-democracy-teesside-plymouth

[5] https://www.great.gov.uk/international/content/investment/how-we-can-help/freeports-in-the-uk/

[6] https://questions-statements.parliament.uk/written-questions/detail/2023-02-06/HL5419/

[7] https://www.bbc.co.uk/news/uk-politics-55819489

[8] https://www.thenational.scot/news/19587798.freeports-scotland-set-green-ports-row-uk/

[9] https://www.gov.scot/news/green-freeports-prospectus-published/

[10] https://greenfreeport.scot/about/

[11] https://forthgreenfreeport.com/

[12] https://assets.publishing.service.gov.uk/media/65ba2e3ae9e10a000d031140/retained_eu_law_parliamentary_report_june_2023_december_2023.pdf

[13] https://www.newstatesman.com/spotlight/2024/01/neoliberal-growth-community-wealth-local-development-labour

[14] https://commonweal.scot/update-indy-demographics/

[15] https://www.thenational.scot/news/20680808.support-rejoining-eu-skyrockets-among-voters-scotland/

[16] https://www.snp.org/policies/pb-what-is-the-snp-s-position-on-rejoining-the-eu/

[17] https://eur-lex.europa.eu/EN/legal-content/summary/treaty-on-the-functioning-of-the-european-union.html

[18] https://www.fdiintelligence.com/content/opinion/its-time-for-the-eu-to-reverse-its-sez-ban-81947

[19] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:32017R1084

[20] https://researchbriefings.files.parliament.uk/documents/CBP-8823/CBP-8823.pdf

[21] https://searchforuksubsidies.beis.gov.uk/

[22] https://searchforuksubsidies.beis.gov.uk/scheme/?scheme=SC11042

[23] https://eur-lex.europa.eu/EN/legal-content/summary/general-block-exemption-regulation.html

[24] https://op.europa.eu/en/publication-detail/-/publication/a40ce9b8-68d0-11ee-9220-01aa75ed71a1/language-en

[25] https://greenfreeport.scot/green-hydrogen/

[26] https://www.scottishlegal.com/articles/calum-macpherson-to-head-inverness-and-cromarty-firth-green-freeport

[27] https://www.iisd.org/itn/en/2023/07/01/norway-terminates-its-iias-with-european-economic-area-members/

[28] https://en.wikipedia.org/wiki/Investor%E2%80%93state_dispute_settlement

[29] https://yourbritain.org.uk/commissions/trade-justice-movement-labour-s-progressive-trade-policy

[30] https://ukandeu.ac.uk/reforming-investor-state-dispute-settlement-eu-initiatives-and-uk-ambivalence/

[31] https://www.gov.scot/publications/scotlands-vision-trade-annual-report-june-2023/pages/5/

[32] https://www.edinburghchamber.co.uk/forth-green-freeport-win-will-drive-forward-net-zero-goals-and-tap-into-the-capitals-coastal-ambitions-says-edinburghs-council-leader/

Leave a Reply